November 26 2021

Equity markets are ending the week on a weaker note, with the FTSE 100 down over 2.5% at the time of writing on the back of news of a new COVID variant. European markets have reacted in similar fashion, with the EStoxx50 over 3.5% and most of Asia weaker this morning. Conversely, government bond yields have fallen, with the UK 10 year gilt falling from just under 1% to 0.85% as we speak. A risk off element has therefore entered the market as they await further news.

Earlier this week we had the release of US GDP for the 3rd quarter. This came in at 2.1% annualised, marginally below the consensus expectation of 2.2%. Personal consumption was a key driver, in particular international travel, transportation and healthcare. The annual growth rate was 4.9% over the same quarter last year.

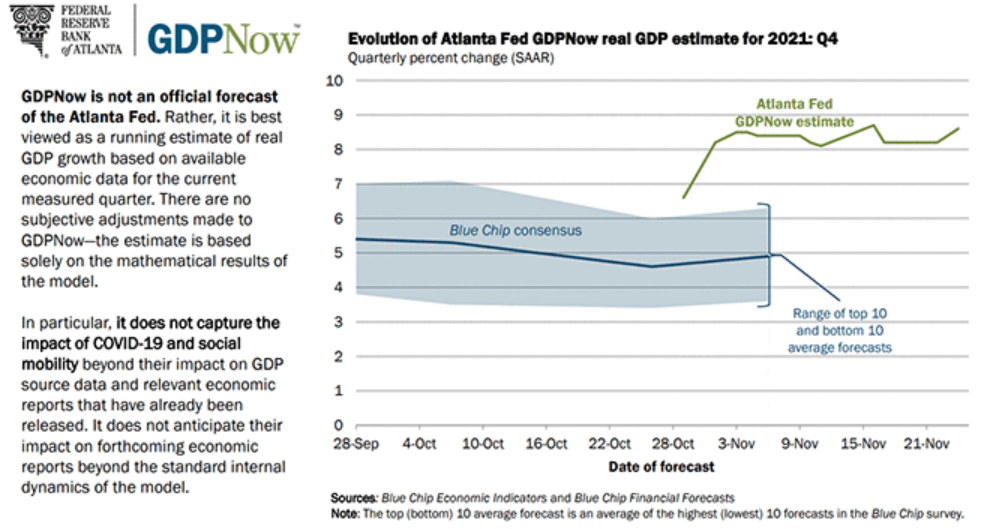

The latest GDPNow model from the Atlanta Fed currently suggests a strong rebound in growth in Q4. The current estimate (24 November) is 8.6%. As we saw in Q3 however things can change quickly here, but a reason to be positive, nonetheless.

Perhaps also in favour of the economy is the level of US household cumulative excess savings. Although the US household savings rate has fall now back to the 10 year average from 2010-2019 of 7.3%, the levels of savings accumulated savings is just below $2.4trn.

From an interest rate perspective the market still believes that central banks will need to react. The probability priced into the market this week of 2 rate hikes by July 2022 by the Fed reached 60% this week.

Company earnings were in focus this week. The latest reading from the Citi US Earnings Revisions index showed that these were not surprising to the upside as strongly as they previously were. US profit margins meanwhile are trading well above their trend level. Historically these have reverted to the mean but they can remain above trend for a sustained period of time. Q4 earnings figures we therefore expect will be watched in earnest.

Finally we end with tech stocks. This week we saw the Nasdaq 100 trade at its highest price to sale ratio since the start of 2001, trading at 5.59 times on the 19 November. Not all is equal in the technology space and there are some companies which are trading well below their all-time highs. For example, Pinterest is 49.8% below, Baidu 55.4%, Alibaba 55.8% and Zoom 55.8%. Whilst these stocks were very much the darlings of the height of the pandemic, through changes in regulation changes and reopening there has been something of a sea change. Not everything last forever, but to quote William Arthur Ward,

“The pessimist complains about the wind; the optimist expects it to change; the realist adjust the sails.”

This article is for information purposes only and should not be construed as advice. We strongly suggest you seek independent financial advice prior to taking any course of action.

The value of this investment can fall as well as rise and investors may get back less than they originally invested. Past performance is not necessarily a guide to future performance.

The Fund is suitable for investors who are seeking to achieve long term capital growth.

The tax treatment of investments depends on the individual circumstances of each client and may be subject to change in the future. The above is in relation to a UK domiciled investor only and would be different for those domiciled outside the UK. We strongly suggest you seek independent tax advice prior to taking any course of action.

Sign up today!

You can unsubscribe at any time by emailing enquiry@lowes.co.uk or by clicking the ‘unsubscribe’ link at the bottom of each email.

Full details of how we use and secure your personal information and how to update your marketing preferences can be viewed in our Privacy Policy